A new one-stop shop for VAT has opened its doors : we explain everything !

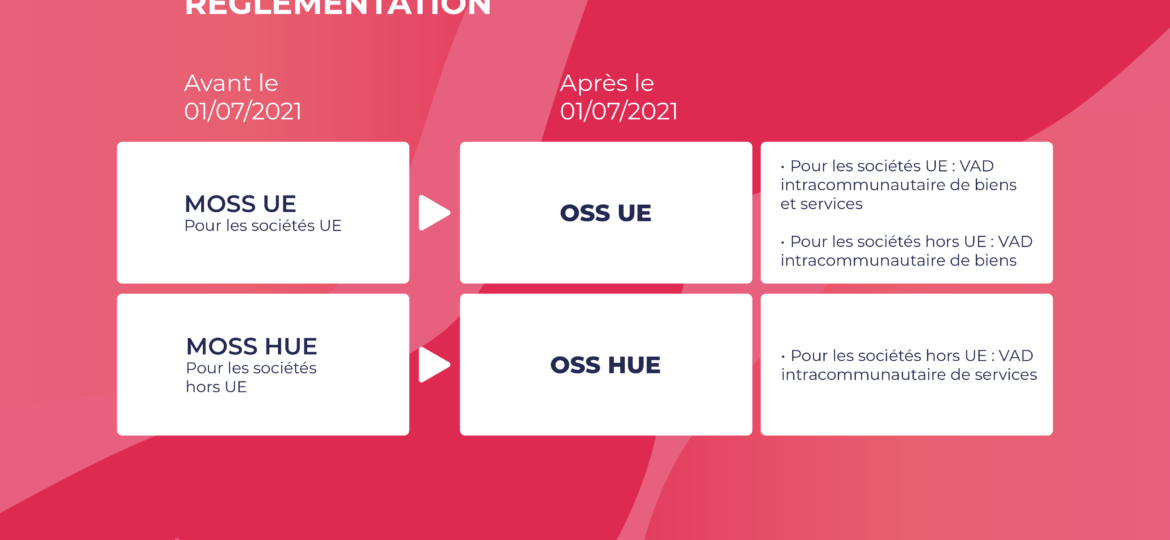

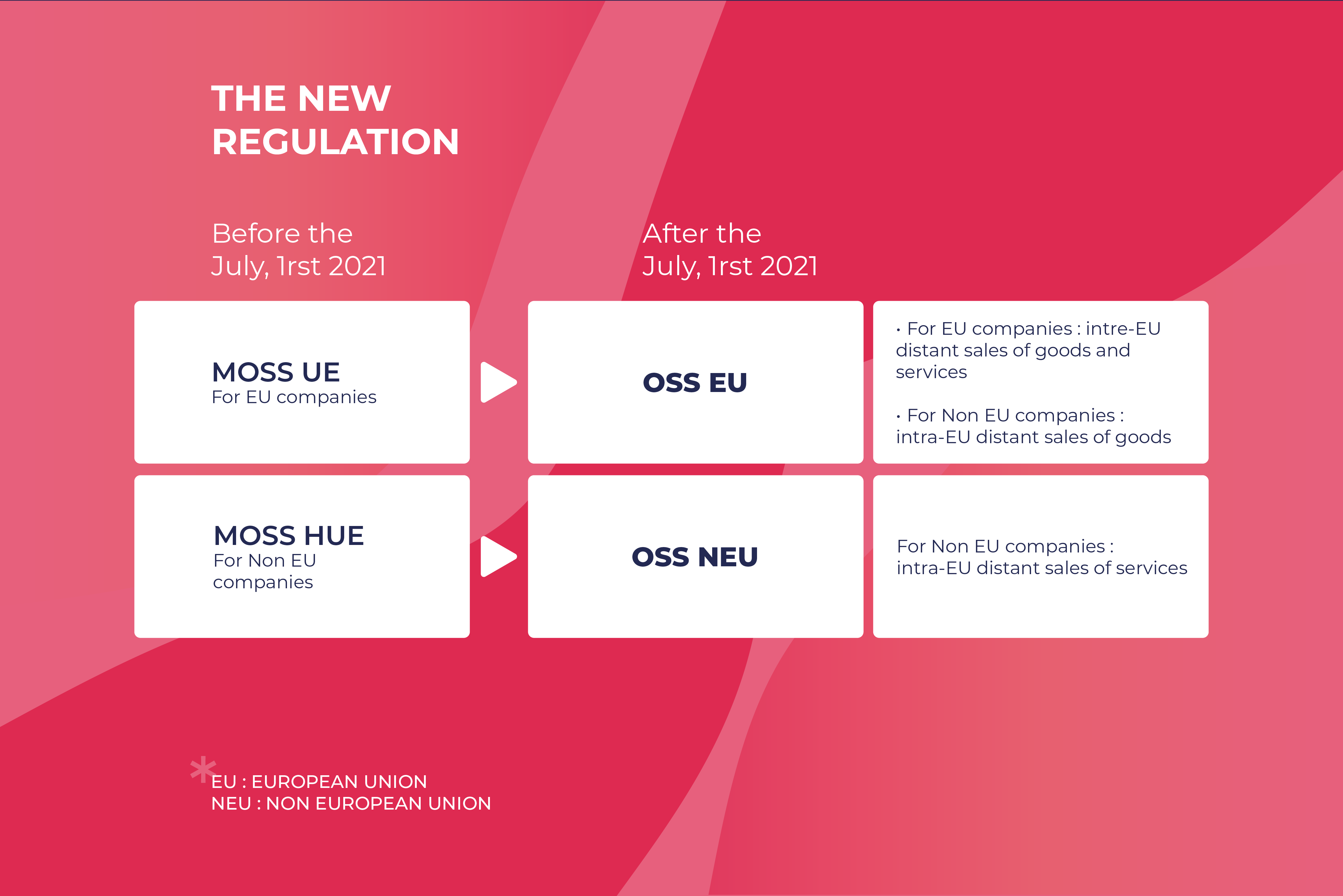

Since July 1, 2021, the MOSS (Mini One Stop Shop) has changed its name and expanded its functions by becoming the OSS (One Stop Shop) VAT to simplify the declaration and payment of VAT within the EU member states provided by the new OSS schemes. But don’t panic, we explain everything and what it involves!

The mini one-stop VAT shop, called mini one stop shop (MOSS), is a simplified VAT identification and payment system introduced in 2015. This shop allowed European Union or Non-European Union companies providing electronic, telecommunication, broadcasting or television services within the European Union (EU) to individuals to declare and pay VAT in the country of consumption. The company centralized its VAT identification within a single interface, allowing a first simplification of the VAT procedures.

The new OSS interface further simplifies the procedures for companies. It allows to declare the turnover realized and the VAT due in the concerned Member States via a single VAT declaration in a single Member State.

It applies to :

- Companies that sell online that provide:

- B2C supplies of services by EU-based suppliers made in a Member State other than the one in which they are established;

- Distance sales of goods within the EU by suppliers established within and outside the EU

- Electronic interfaces that carry out:

- Distance sales of goods within the EU

- Certain domestic deliveries of goods

If you carry out any of these activities concerning the OSS, you should know that it is no longer obliged to register with the tax authorities of each State of the European Union of consumption to declare and pay the VAT due. The new one-stop shop allows to declare and pay VAT to a single state electronically. The European Union VAT One-Stop Shop is available to businesses that are established both within and outside the European Union.

The one-stop shop is optional, so you are not obliged to set it up. However, it does greatly simplify the VAT processes for the companies involved, allowing them to :

- Register for VAT electronically in a single Member State for all sales of goods and services that may fall within the scope of the one-stop shop to customers in other Member States;

- To file a single electronic VAT return with the one-stop shop and to make a single VAT payment for all sales of goods and services;

- Communicate in a single language with the tax authorities of the country in which they are registered for the one-stop shop.

How to register ?

All EU member states have an online portal for OSS where companies can register. This is a one-time registration for the activities of companies eligible for the OSS scheme.

If you want to register in France for the guichet OSS, just click here to complete the online steps.

If you are still wondering whether you can use the new one-stop shop or if you have difficulties to register in France for the one-stop shop, please contact us at international@akoneo.fr , we will be happy to help you!